-

-

North

-

Midlands & East

-

London

-

South West

-

Before you continue

Generic error message

The selected items have been added to your basket

View BasketYour Basket will expire in time minutes.

Appendix 1: The Trustees Investment Strategy

Appendix 2: Fund Details

|

Glossary |

|

|

Allianz |

Allianz Global Investors GmbH |

|

AVCs |

Additional Voluntary Contributions |

|

Aviva |

Aviva Investors UK Fund Services Limited |

|

BlackRock |

BlackRock Investment Management (UK) Limited |

|

ESG |

Environmental, Social and Governance (including, but not limited to, climate change) |

|

LDI |

Liability Driven Investment |

|

Partners |

Partners Group (Guernsey) Limited |

|

Scheme |

Jockey Club Racecourses Pension Scheme |

|

Trustees |

The Trustees of the Scheme |

|

UNPRI |

United Nations Principles for Responsible Investment |

This statement is made in accordance with the requirements of legislation[1] and, in determining a suitable investment strategy for the Scheme, the Trustees have considered The Pension Regulator’s Investment Guidance for defined benefit pension schemes.

The main body of this statement sets out the principles and policies that govern investments made by the Trustees of the Scheme. Details of the specific investment arrangements in place are set out in the Appendices.

Upon request, a copy of this statement will be made available to members, the Scheme Actuary and any investment managers used by the Trustees. This statement will also be made publicly available, as required by legislation.

Investment Advice

As required by legislation, in the preparation and maintenance of this statement and when considering the suitability of any investments, the Trustees will obtain and consider written advice from their investment adviser.

The Trustees are advised on investment matters by First Actuarial LLP. First Actuarial LLP is regulated by the Institute and Faculty of Actuaries and is qualified to provide the required advice through knowledge and practical experience of financial matters relating to pension schemes.

Legal Advice

Whenever deemed necessary, the Trustees will seek advice from their legal adviser on investment matters.

Employer Consultation

Under legislation, the ultimate responsibility for determining the investment strategy rests with the Trustees. However, the Trustees must consult with the sponsoring employer and consultation must comprise a sharing of views, not simply notification of intent.

Investment Managers

Day-to-day management of the Scheme’s assets is delegated to one or more investment managers.

To ensure safekeeping of the assets, ownership and day to day control of the assets is undertaken by custodian organisations which are independent of the sponsoring employer and the investment managers. Where pooled investment vehicles are used, the custodians will typically be appointed by the investment manager.

Members’ Views and Other Non-Financial Matters

In the relevant regulations “non-financial matters” refers to the views of the members. This can include, but is not limited to, ethical views, views on certain ESG factors and views on the present and future quality of life for the members.

The Trustees recognise that it is likely that members and beneficiaries will hold a broad range of views. However, the Trustees do not take non-financial matters into account in the selection, retention and realisation of investments. The Trustees will review their policy on whether or not to take account of non-financial matters as appropriate.

The Trustees believe that their duty to members and beneficiaries will be best served by ensuring that all benefits can be paid as they fall due and the Trustees' Investment Objectives are designed to ensure this duty is achieved.

Conflicts of Interest

The Trustees are satisfied that the investment strategy described in this Statement meets their responsibility to invest the assets in the best interests of the members and beneficiaries and, in the case of a potential conflict of interest, in the sole interest of the members and beneficiaries.

The investment beliefs stated below have been developed by the Trustees and are reflected in the Scheme’s investment strategy.

Appropriate Time Horizon

In determining investment objectives and a suitable investment strategy for the Scheme, the Trustees take into account an appropriate time horizon. The Trustees believe that an appropriate time horizon will be the period over which benefits are expected to be paid from the Scheme.

Risk versus Reward

Targeting higher levels of investment return requires increased levels of investment risk which increases the volatility of the funding position.

Asset Allocation

Long-term performance of the Scheme’s assets is attributable primarily to the strategic asset allocation rather than the choice of investment managers.

Diversification

Asset diversification helps to reduce risk.

Use of Pooled Funds

Taking into account the size of the Scheme’s assets, it is expected that pooled funds will typically be a more practical way of implementing the Scheme’s investment strategy than establishing segregated mandates with investment managers.

Use of Active Management

Active management has the potential to add value either through offering the prospect of enhanced returns or through the control of volatility. In addition, it is recognised that active management may help to mitigate the financial impact of ESG risks.

For each asset class, the Trustees will consider whether the higher fees associated with active management are justified.

ESG and Other Financially Material Considerations

The Trustees believe that financially material considerations, including certain ESG factors and the risks related to such factors, can contribute to the identification of both investment opportunities and financially material risks. Consequently, financially material considerations can have a material impact on investment risk and return outcomes.

The Trustees also recognise that long-term sustainability issues, particularly climate change, present risks and opportunities that increasingly may require explicit consideration.

Assessment of how ESG risks are mitigated will be one of the factors considered by the Trustees when selecting and monitoring investment managers.

Stewardship

The Trustees believe that good stewardship can help create, and preserve, value for companies and markets as a whole, which is in the best interests of members as better run enterprises are more likely to perform better over the longer term.

Defined Benefit Assets – Investment Objectives

The Trustees' primary investment objectives are:

The Trustees' investment approach is designed to strike a balance between the above primary objectives but also considers:

Defined Benefit Assets – Investment strategy

The Trustees have taken advice from their investment adviser to construct a portfolio of investments consistent with these objectives. In doing so, consideration is given to all matters which are believed to be financially material over the appropriate time horizon.

The Trustees do not explicitly consider non-financial matters when determining the Scheme’s investment strategy.

AVCs

Additional Voluntary Contributions (AVCs) are held separately from the main assets and the Trustees aim to make a variety of funds available with the member choosing which funds to use. From time to time the Trustees review the range of available funds to ensure the choice remains appropriate for members' needs.

Details of the current AVC arrangements are provided in

Appendix 1.

Investment Manager Selection

The Trustees delegate the day to day management of the assets, including selection, retention and realisation, to professional investment managers.

When considering the suitability of an investment manager, the Trustees (in conjunction with their investment adviser), will take account of all matters which are deemed to be financially material. In particular, the Trustees will:

When selecting investment managers, the Trustees may also take into account non-financially material considerations such as the investment manager’s administrative capabilities and the liquidity of the investments.

Where pooled investment vehicles are used, it is recognised that the mandate cannot be tailored to the Trustees' particular requirements. However, the Trustees ensure that any pooled investment vehicles used are appropriate to the circumstances of the Scheme.

The Trustees will normally select investment managers who are signatories to the UNPRI and who publish the results of their annual UNPRI assessment. This principle may be waived if a fund offered by a non-signatory manager is deemed to have investment characteristics which are particularly important for meeting the Trustees' investment objectives.

Manager Implementation

Assets are invested predominantly on regulated markets, as so defined in legislation. Any investments that do not trade on regulated markets are kept to a prudent level.

Use of Derivatives

The investment managers are permitted to use derivative instruments to reduce risk or for efficient portfolio management. Risk reduction would include mitigating the impact of a potential fall in markets or the implementation of currency hedging whilst efficient portfolio management would include using derivatives as a cost-effective way of gaining access to a market or as a method for generating capital and/or income with an acceptable level of risk.

Leverage

The instruments used by the investment managers of the Liability Matching Assets may result in the Liability Matching Assets being leveraged. Since these assets are closely aligned to the liabilities, the allocation to Liability Matching Assets (and any associated leverage) reduces the volatility of the Scheme’s funding position and therefore reduces risk.

The Trustees' policy in relation to the exercise of rights attaching to investments, and undertaking engagement activities in respect of investments, is that they wish to encourage best practice in terms of stewardship.

However, the Trustees invest in pooled investment vehicles and therefore accept that ongoing engagement with the underlying companies (including the exercise of voting rights) will be determined by the investment managers’ own policies on such matters. For that reason, the Trustees recognise that their ability to directly influence the action of companies is limited.

Nevertheless, the Trustees expect that each investment manager will discharge its responsibilities in respect of investee companies in accordance with that investment manager’s own corporate governance policies and current best practice, including the UK Corporate Governance Code and UK Stewardship Code.

The Trustees also expect that each investment manager will take ESG factors into account when exercising the rights attaching to investments and in taking decisions relating to the selection, retention and realisation of investments.

When considering the suitability of an investment manager, the Trustees (in conjunction with their investment adviser) will take account of any particular characteristics of that manager’s engagement policy that are deemed to be financially material.

The Trustees recognise that the members might wish the Trustees to engage with the underlying companies in which the Scheme invests with the objective of improving corporate behaviour to benefit the environment and society.

However, the Trustees' priority is to select investment managers which are best suited to help meet the Trustees' investment objectives. In making this assessment, the Trustees will receive advice from their investment adviser. The Trustees recognise that the investment managers’ own policies are likely to be focussed on maximising financial returns and minimising financial risks rather than targeting an environmental or societal benefit.

As the Scheme’s assets are held in pooled funds, the Trustees have limited influence over the investment managers’ investment decisions. In practice, investment managers cannot fully align their strategy and decisions to the (potentially conflicting) policies of all their pooled fund investors in relation to strategy, long-term performance of debt/equity issuers, engagement and portfolio turnover.

It is therefore the Trustees' responsibility to ensure that the approaches adopted by investment managers are consistent with the Trustees' policies before any new appointment, and to monitor and to consider terminating any existing arrangements that appear to be investing contrary to those policies.

The Trustees expect investment managers, where appropriate, to make decisions based on assessments of the longer term financial and non-financial performance of debt/equity issuers, and to engage with issuers to improve their performance. The Trustees assess this when selecting and monitoring managers.

The Trustees' policy on selecting, monitoring, evaluating and (where necessary) terminating these arrangements is set out in further detail below.

Compatibility of Pooled Funds with the Trustees'

Investment Strategy

When selecting a pooled fund, the Trustees consider various factors, including:

*This includes engaging with an issuer of debt or equity regarding matters including (but not limited to) performance, strategy, capital structure, management of actual or potential conflicts of interest, risks, and ESG matters. It also includes engaging on these matters with other investment managers, other holders of debt or equity and persons or groups of persons who have an interest in the issuer of debt or equity.

After analysing the above characteristics for a fund, the Trustees identify how that fund would fit within their overall investment strategy for the Scheme and how the fund is expected to help the Trustees meet their investment objectives.

Duration of Investment Manager Arrangements

The Trustees normally expect that pooled funds will be held for several years.

However, as part of the periodic strategic asset allocation reviews (which take place at least every three years), the Trustees will review whether the ongoing use of each fund remains consistent with their investment strategy.

The Trustees regularly monitor the financial and non-financial performance of the pooled funds held and details of this monitoring process is set out below. If the Trustees become concerned about the ongoing suitability of a pooled fund, they may reduce exposure to it or disinvest entirely. Such action is expected to be infrequent.

Monitoring Pooled Funds

The Trustees regularly assess the performance of each fund held and this monitoring includes an assessment of whether the investment manager continues to operate the fund in a manner that is consistent with the factors used by the Trustees to select the fund (as listed above).

When assessing the performance of a fund, the Trustees do not usually place too much emphasis on short-term performance although they will seek to ensure that reasons for short-term performance (whether favourable or unfavourable) are understood.

The Trustees expect the investment managers of pooled funds to invest for the medium to long term and they expect investment managers to engage with issuers of debt or equity with a view to improving performance over this time frame.

If it is identified that a fund is not being operated in a manner consistent with the factors used by the Trustees to select the fund, or that the investment manager is not engaging with issuers of debt or equity, the Trustees may look to replace that fund. However, in the first instance, the Trustees would normally expect their investment adviser to raise the Trustees' concerns with the investment manager.

Thereafter, the Trustees, in conjunction with their investment adviser, would monitor the performance of the fund to assess whether the situation improves.

The Trustees expect to summarise certain aspects of their monitoring, particularly in relation to stewardship, in an annually produced Implementation Statement.

Portfolio Turnover

The Trustees are aware of the requirement to monitor portfolio turnover costs (the costs incurred as a result of the buying, selling, lending or borrowing of investments).

When selecting a pooled fund, the Trustees will consider how the investment manager defines and measures:

At least annually, the Trustees, in conjunction with their investment adviser, will consider the transaction costs incurred on each pooled fund. As part of this analysis, the Trustees will consider whether the incurred turnover costs have been in line with expectations.

The Trustees will take the above information on portfolio turnover into account when assessing the ongoing suitability of each pooled fund.

When determining suitable investment objectives and when designing the Scheme’s investment strategy, the Trustees (in conjunction with their investment adviser), will take into account all risks that are assessed to be financially material. The principal investment risks are listed in the Trustees' Investment Risk Policy. That Policy also provides an explanation of how the investment risks are managed.

Risk Capacity and Risk Appetite

In determining a suitable investment strategy, the Trustees consider how the volatility of the funding position is likely to be affected by changes to the asset allocation. An important consideration for the Trustees is whether a potential investment strategy is consistent with the ability of the sponsoring employer to address any future increase in deficit that may arise due to market movements.

Self-Investment Risk

Legislation imposes a restriction that no more than 5% of a pension scheme’s assets may be related to the sponsoring employer. The Trustees do not hold any direct employer-related assets and any indirect exposure is expected to be less than 5% of total assets.

ESG Risks

The Trustees (in conjunction with their investment adviser) have considered the likely impact of the financially material ESG risks associated with all of the Scheme’s investments and have assessed the mitigation of such risks implemented by each of the investment managers. In making this assessment, the Trustees recognise that, where pooled investment vehicles are held, the extent to which ESG factors will be used in the selection of suitable underlying investments will be determined by the investment managers’ own policies on such matters.

The Trustees however consider ESG factors to be important and this is reflected by the introduction of an ESG-focussed equity fund following a robust assessment process.

Liquidity Risk

The majority of the Scheme’s investments will be liquid and will be realisable for cash at relatively short notice without incurring high costs. However, the Trustees recognise that the liabilities are long-term in nature and that a modest allocation to less-liquid investments may be appropriate.

Details of the liquidity characteristics of the funds held are provided in Appendix 2.

The Trustees regularly review the Scheme’s investments for all matters considered to be financially material over the future period for which benefits are expected to be paid from the Scheme. This includes reviewing that the assets continue to be managed in accordance with each manager’s mandate and that the choice of managers remains appropriate.

Furthermore, the Trustees regularly monitor the position of the investment managers with regards to ESG matters.

To assist with the monitoring of the investment managers, the Trustees receive regular information from their investment adviser providing details of investment manager performance and asset allocation decisions. This analysis includes comparisons with benchmarks and relevant peer-group data.

The analysis assesses whether performance has been in line with expectations given market conditions and whether the level of risk has been as expected.

The investment adviser also provides regular updates on the investment managers’ actions regarding ESG factors and shareholder engagement.

The investment adviser regularly meets with the managers of pooled funds on its approved list.

This statement will be reviewed at least every three years and without delay after any significant change in circumstances or investment strategy.

The Trustees have consulted with the sponsoring employer as part of the work preparing this statement.

The principles set out in this Statement have been agreed by the Trustees:

Signed:…………………………………………………… Date: ………………………

For and on behalf of the Trustees of the Jockey Club Racecourses Pension Scheme.

Appendix 1: The Trustees' Investment Strategy

Strategic Asset Allocation

In determining the strategic asset allocation, the Trustees view the investments as falling into two broad categories:

In addition, the Trustees may hold cash. Cash will normally be held in the Trustees' bank account if it is to be used to make payments due in the short-term whereas cash that is to be held for more than a few weeks will normally be held in a cash fund.

At the time of preparing this statement, the Scheme was in the process of moving towards the allocations described below. The expected split of the Scheme’s assets between the above categories, once the transition is complete, is approximately 76% Growth and 24% Liability Matching.

The split of the Scheme’s assets between Growth and Liability Matching Assets is not regularly rebalanced and will vary over time as market conditions change.

The Trustees will review the strategic asset allocation periodically, and at least every three years, to ensure that the investment strategy remains consistent with the Trustees' funding objectives. As part of such a review, the Trustees will consider the risks associated with the investment strategy.

Investment Strategy Implementation

The Trustees have selected funds managed by Allianz, Aviva, BlackRock and Partners to implement the Scheme’s investment strategy.

Further details of the investment strategy and the funds used are provided below.

Appendix 1: The Trustees' Investment Strategy (continued)

Design of the Growth Asset Portfolio

The structure of the Scheme’s Growth Assets has been designed to offer diversification across a range of underlying asset classes and to achieve this by combining investment managers with different asset management styles.

The strategic allocation for the Scheme’s Growth Assets is as follows:

|

Pooled Fund |

Strategic Allocation of the Growth Assets |

|

Allianz Global Multi-Sector Credit Fund |

11% |

|

BlackRock Dynamic Diversified Growth Fund |

9% |

|

BlackRock Institutional Equity Funds – Emerging Markets |

5.5% |

|

Partners Fund (Guernsey) |

7% |

|

Aviva Lime Property Fund |

13% |

|

BlackRock Sterling Short Duration Credit Fund |

7.5% |

|

BlackRock ACS World ESG Equity Tracker Fund |

47% |

|

Total Growth Assets |

100% |

The allocation of the Growth Assets is not automatically rebalanced but will be monitored and rebalanced at the discretion of the Trustees.

Design of the Liability Matching Portfolio

The Scheme’s Liability Matching Assets are invested in leveraged Liability Driven Investment (LDI) funds managed by BlackRock. The funds used are:

|

· BlackRock LMF Leveraged 2032 Index Linked Gilt Fund |

· BlackRock LMF Leveraged 2068 Index Linked Gilt Fund |

|

· BlackRock LMF Leveraged 2040 Index Linked Gilt Fund |

· BlackRock LMF Leveraged 2040 Gilt Fund |

|

· BlackRock LMF Leveraged 2050 Index Linked Gilt Fund |

· BlackRock LMF Leveraged 2052 Gilt Fund |

|

· BlackRock LMF Leveraged 2062 Index Linked Gilt Fund |

· BlackRock LMF Leveraged 2068 Gilt Fund |

The current allocation to LDI funds is expected to hedge approximately 65% of funded liabilities in terms of interest rate and inflation exposures (noting that this analysis is approximate and due to be refreshed in the near future). The Trustees expect the LDI allocation (and hence level of hedging) to increase over time as the Scheme matures.

Cash

The Trustees may invest in the BlackRock ICS - Sterling Liquidity Fund.

Appendix 1: The Trustees' Investment Strategy (continued)

LDI Leverage Management Policy

In an environment of rising yields, a recapitalisation payment may need to be paid into one or more of the LDI funds. This will ensure that leverage within the LDI funds remains within a permissible range.

The Trustees have provided BlackRock with authority to meet a recapitalisation contribution by selling assets in the following order:

If the leverage of a BlackRock LDI fund falls below a minimum threshold, BlackRock will make a cash payment from the relevant fund to raise the leverage. The Trustees have provided BlackRock with authority to invest any such cash proceeds in the BlackRock Sterling Short Duration Credit Fund.

Cashflow Management Policy

Any investments or disinvestments will be made at the discretion of the Trustees, but the Trustees will maintain a Cashflow Management Policy which will record how such payments should be structured. The Cashflow Management Policy will be designed to ensure the allocation of the Scheme’s assets remains closely aligned with the strategy described in this statement.

To ensure the Scheme operates efficiently, the Trustees may share the Cashflow Management Policy with the individual(s) responsible for processing payments from the Scheme.

The Cashflow Management Policy will be reviewed from time-to-time by the Trustees and, as a minimum, at least every three years in line with a review of this statement. Given that the Cashflow Management Policy is designed to keep the Scheme’s asset allocation aligned with the investment strategy and investment principles described in this statement, the sponsoring employer is satisfied that the Cashflow Management Policy can be amended by the Trustees without consulting the sponsoring employer.

Additional Voluntary Contributions

The Scheme’s AVC arrangements are held with Royal London and Utmost Life and Pensions (Utmost) formerly Equitable Life.

This Appendix provides a summary of the funds used to implement the Scheme’s investment strategy. The details provided below were correct as at March 2021

The following points should be noted:

|

Allianz Global Multi-Sector Credit Fund |

||

|

Objective |

The Allianz Global Multi Sector Credit Fund invests in a wide variety of credit assets including investments grade bonds, high yield bonds, emerging market credit and securitised debt, aiming to outperform LIBOR by 3% p.a. over 3 years, gross of fees. |

|

|

Legal Structure |

Investment Company with Variable Capital |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.42% p.a. |

|

Additional Expenses (approx.): |

0.00% p.a. |

|

Appendix 2: Fund Details (continued)

|

BlackRock Dynamic Diversified Growth Fund |

||

|

Objective |

This fund targets capital growth by investing in a diversified portfolio of equities, bonds, property and cash. Derivatives (exchange traded and over-the-counter) may be used for efficient portfolio management and to hedge underlying positions. The fund's performance objective is to outperform cash (3 month LIBOR) by 3% p.a. (net of fees) over rolling 3 year periods. |

|

|

Legal Structure |

Investment Company with Variable Capital |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.55% p.a. |

|

Additional Expenses (approx.): |

0.12% p.a. |

|

|

BlackRock Institutional Equity Funds – Emerging Markets |

||

|

Objective |

The BlackRock Institutional Equity Funds - Emerging Markets will seek to maximise the long-term total return by investing in emerging economies (directly or indirectly). Investments will be made in Latin America, Eastern and Southern Europe, Asia and Africa. |

|

|

Legal Structure |

Unit-linked insurance policy |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T-1 |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.75% p.a. |

|

Additional Expenses (approx.): |

0.20% p.a. |

|

Appendix 2: Fund Details (continued)

|

Partners Fund (Guernsey) |

|

|

Objective |

The Fund aims to deliver 8-12% p.a. over a full economic cycle. |

|

Legal Structure |

Unit Trust |

|

Trading Frequency |

Monthly |

|

Notice Period |

T – (1 Month plus 1 business day) |

|

Settlement Period |

T+24 |

|

Fee |

1.5% of NAV plus unfunded commitments plus performance fee of 12.5% over a high watermark. |

|

Aviva Lime Property Fund |

||

|

Objective |

The Aviva Lime Property Fund aims to achieve investment returns in excess of 1.5% (net of costs) p.a. above gilts over the medium to long term by investing in lower risk property assets with secure long term income streams. |

|

|

Legal Structure |

Unit Trust |

|

|

Trading Frequency |

Monthly priced. Redemptions are annual as at 31 December. The manager has the ability to defer payment for up to 12 months. |

|

|

Notice Period |

6 months |

|

|

Fee |

AMC: |

0.40% p.a. |

|

Additional Expenses (approx.): |

0.12% p.a. |

|

Appendix 2: Fund Details (continued)

|

BlackRock Sterling Short Duration Credit Fund |

||

|

Objective |

To generate income returns, with the prospect of capital growth, through an actively managed portfolio of predominantly corporate bonds with durations less than 5 years. The target of the fund is to return cash (LIBOR) +1.5% p.a., gross of fees, over a rolling 3-year period. |

|

|

Legal Structure |

Unit-linked insurance policy |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T-1 |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.15% p.a. |

|

Additional Expenses (approx.): |

0.05% p.a. |

|

|

BlackRock ACS World ESG Equity Tracker Fund |

||

|

Objective |

The Fund aims to provide a return by tracking the performance of the MSCI World ESG Focus Low Carbon Screened Index, the Fund’s benchmark, to within 0.5%, by investing in shares of companies that make up the benchmark. |

|

|

Legal Structure |

Unit-linked insurance policy |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T-1 |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.14% p.a. |

|

Additional Expenses (approx.): |

0.03% p.a. |

|

Appendix 2: Fund Details (continued)

|

BlackRock LMF Leveraged Gilt and Index Linked Gilt Funds |

||

|

Objective |

To provide leveraged exposure to the appropriate Treasury Gilt or Index-Linked Gilt. The funds are designed to be held until maturity and aim to provide a single payment on the specified maturity date of the underlying reference gilt. Due to the leveraged nature of the Funds, every £1 invested in the Funds provides more than £1 worth of exposure to the underlying reference gilt. |

|

|

Legal Structure |

Unit Trust |

|

|

Trading Frequency |

Daily |

|

|

Notice Period |

T-1 |

|

|

Settlement Period |

T+3 |

|

|

Fee |

AMC: |

0.15% p.a. |

|

Additional Expenses (approx.): |

0.00% p.a. |

|

[1] In particular, the Pensions Act 1995, the Occupational Pensions (Investment) Regulations 2005 and the Pension Protection Fund (Pensionable Service) and Occupational Pension Schemes (Investment and Disclosure) (Amendment and Modification) Regulations 2018 and the Occupational Pension Schemes (Investment and Disclosure) (Amendment) Regulations 2019.

The Jockey Club Racecourses Pension Scheme (“the Scheme”)

Chair’s Statement – 31 July 2023

In accordance with the requirements of the Occupational Pension Schemes (Charges and Governance) Regulations 2015 (‘the Regulations’), the Trustees are required to provide a statement relating to the governance of the defined contribution benefits within the Scheme.

This statement covers the period from 1 August 2022 to 31 July 2023 and has been prepared by the Chair of the Trustees – William Medlicott.

In this scheme there are two different sets of DC members; those with Protected Rights and those who are AVC members.

For Protected Rights Account members, the following sections will cover Governance, Charges and Net Investment returns.

For AVC only members, please refer to the sections that follow the Protected Rights Account members information.

Background

The Scheme is a defined benefit (DB) arrangement which means that the benefits are calculated on a pre-determined basis specified in the Scheme Rules. The Scheme was contracted out using the protected rights method in respect of service accrued after 6 April 1997 (providing each member with a protected rights account). These protected rights accounts act as an underpin to the defined benefits payable under the Scheme Rules.

Upon retirement, death or transferring out of the Scheme, the value of the defined benefit is checked against the value of the protected rights account and the higher benefit is provided to the member.

The assets in relation to these protected rights benefits are invested within the DB assets of the Scheme. Members therefore have a notional protected rights account, which is valued in line with the return on the Scheme’s DB assets.

Where members had less than two years’ service and left the Scheme prior to 6 April 2012, their protected rights accounts were retained within the Scheme and form a defined contribution (DC) only benefit as at that time, it was not possible to provide a return of contributions in respect of their protected rights contributions.

Following the abolition of protected rights on 6 April 2012, the Trustees made a resolution in June 2012 which converted members’ protected rights funds into individual accumulation funds which act in the same way as non-protected rights funds but continued to act as an underpin to post 97 benefits.

The Trustees are currently in the process of discharging these benefits with a small number of members trying to be traced to complete the exercise.

In addition to those members with protected rights accounts, all members could make additional voluntary contributions (AVCs) on a DC basis to provide additional benefits at retirement.

Governance of the Default Investment Arrangement

Protected Rights Account

The assets in relation to the protected rights benefits are invested within the Scheme’s DB assets. As such, this is the Scheme’s default investment arrangement for DC benefits, as defined in the Regulations.

In the Scheme there are members with Protected Rights only and others who have Protected Rights with DB benefits as well.

As part of the actuarial valuation as of 31 July 2023, using best estimate valuation calculations, the total Protected Rights underpin amount was £900,000 consisting of £55,000 in respect of Protected Right only members and £845,000 for those with a Protected Rights underpin with DB benefits.

The Trustees do not formally review the investment strategy of the assets attributed to the DC protected rights accounts to assess its appropriateness for members but regularly review the investment strategy and performance of the assets in relation to the DB funding. The last formal review of the investment strategy for the Scheme’s DB assets was in April 2021 with further consideration given more recently resulting in a series of adjustments made to the strategy.

Charges and Transaction Costs

Protected Rights Account

The investment returns on the Scheme’s DB assets considers the annual fund management charges of between 0.14% to 1.50% depending on the investment fund. However, members with Protected Rights benefits have notional holdings in the DB scheme and for the purposes of the valuation of these benefits, assumed investment growth is linked to the FTSE All Share Total Return index and an allowance for investment expenses of 0.50% pa is made.

These charges are incurred by members when valuing their protected rights accounts to assess whether the underpin bites. Given this basis of valuation, a projection of the effect of charges and costs has not been included as a result.

Net Investment Returns for the DC Section

Protected Rights Account

The following table reflects the actual performance of the DB Scheme over varying periods which the DC Section’s returns are based on.

These returns have been manually calculated using growth asset only returns taken from the report and accounts over the last 3 years ending 31 July 2023.

|

Fund % pa |

1 year |

3 years |

|

Protected Rights Account |

-0.05% |

7.50% |

The Trustees have prepared a Statement of Investment Principles which sets out the Trustees’ aims and objectives relating to {the Defined Benefit/} investment strategy. A copy of the SIP can be found https://www.thejockeyclub.co.uk/defined-benefit-pension-scheme/

Governance of the Default Investment Arrangement

AVC only

There is no default investment fund requirement for AVC members, with a range of funds available for investment.

As of 31 July 2023, the AVC funds under management were:

|

Fund |

Funds under Management |

|

Utmost Life and Pensions |

£67,443 |

|

Royal London |

£297,872 |

|

Total |

£365,315 |

The Scheme currently offers a range of AVC investment choices with both Utmost Life and Pensions (Utmost, formerly Equitable Life) and Royal London. The Scheme deemed default investment arrangement for the AVCs, as defined in the Regulations, is the Cautious Lifestyle Strategy (Annuity) with Royal London, under which funds are invested more cautiously as members near retirement age, with the aim of buying an annuity at retirement. The default investment option changed from the Cautious Retirement Investment Strategy in 2021, as part of a review which Royal London conducted on its legacy strategies.

The underlying funds which make up the Cautious Lifestyle Strategy (Annuity) and the de-risking period is detailed in the table below:

|

Fund |

Time Period |

|

Royal London Governed Portfolio 1 |

15 years or more from retirement |

|

Royal London Governed Portfolio 2 (Annuity) |

10 years from retirement |

|

Royal London Governed Portfolio 3 (Annuity) |

5 years from retirement |

|

Royal London Annuity |

At Retirement |

On 1 January 2020, Equitable Life transferred all its policies to Utmost, and members who were invested in the With Profits fund had their fund holdings switched to Unit Linked funds from this date. Monies previously held in the Secure Cash fund for the first 6 months moved into the Investing at Age range of funds with effect from 1 July 2020.

As part of the transition from Equitable Life to Utmost, the Trustees communicated details to members about the default lifestyle fund options with Utmost, recommending that members consider whether the way in which their AVCs are invested remains appropriate.

The Trustees considered the appropriateness of the current AVC arrangements in June 2023, as well as the options available to them. This review was undertaken in the knowledge that most members use their AVC funds as the first option to provide additional tax-free cash at retirement. The Trustees concluded that no changes needed to be made at this time, however they Trustees plan to communicate to members about the options available to them in relation to the AVC arrangements.

Charges and Transaction Costs

AVCs only

In addition to the default option, members are able to self-select their AVC investment funds. The total expense ratio (TER) for each fund, which is made up of an annual management charge and other indirect costs for the Royal London funds is 0.53% pa.

All AVC funds under management with Utmost have been invested in Unit Linked funds since 1 January 2020. These funds are subject to an ongoing investment management charge between 0.53% - 0.75% per annum. The TER charge for the Clerical Medical With-Profits fund is considered when declaring annual interest rates rather than being an explicit charge deducted from members’ funds.

In addition to these explicit member charges, members may also incur transaction costs (incurred as a result of buying, selling, lending or borrowing investments). The transaction costs for the Royal London funds are calculated to 31 July 2023 and the Utmost/Clerical Medical funds are to 30 June 2023.

The following tables summarise the total costs and charges for the funds invested in, as follows:

ROYAL LONDON FUNDS

|

Fund |

Total Expense Ratio (TER) |

Transaction costs (%) |

Total costs to members |

|

Royal London Cautious Retirement Investment Strategy (default) |

|||

|

Royal London Governed Portfolio 1 |

0.53% |

0.05% |

0.58% |

|

Royal London Governed Portfolio 2 (Annuity) |

0.53% |

0.01% |

0.54% |

|

Royal London Governed Portfolio 3 (Annuity) |

0.53% |

0.00% |

0.53% |

|

Royal London Annuity |

0.53% |

0.00% |

0.53% |

|

Self-select funds |

|||

|

Royal London Deposit |

0.53% |

0.05% |

0.58% |

|

Royal London European |

0.53% |

0.00% |

0.53% |

|

Royal London Fixed Interest |

0.53% |

0.03% |

0.56% |

|

Royal London Managed |

0.53% |

0.06% |

0.59% |

|

Royal London Property |

0.53% |

0.07% |

0.60% |

|

Royal London BlackRock ACS Global Equity Index (60:40) |

0.53% |

0.00% |

0.53% |

|

Royal London Blackrock Consensus |

0.53% |

0.09% |

0.62% |

|

Royal London With Profits |

0.53% |

0.12%* |

0.65% |

Utmost Funds

|

Fund |

Total Expense Ratio (TER) |

Transaction costs (%) |

Total costs to members |

|

Self-select funds |

|||

|

Utmost Investing at Age ** |

0.75% |

0.24% -0.29% |

0.99% - 1.04% |

|

Utmost Multi Asset Moderate |

0.75% |

0.24% |

0.99% |

|

Utmost Multi Asset Cautious |

0.75% |

0.29% |

1.04% |

|

Utmost Money Market (Deposit) |

0.50% |

0.01% |

0.51% |

|

Utmost Managed |

0.75% |

0.20% |

0.95% |

|

Utmost UK Equity |

0.75% |

0.28% |

1.03% |

|

Clerical Medical With-Profits*** |

0.50% |

0.39% |

0.89% |

* Transaction charge is to 31 December 2021.

** Members of Equitable Life’s With-Profits Fund were transferred into Utmost’s Secure Cash Fund on 1 January and remained there until 30 June 2020. Where no election was made to transfer to another fund during this period, members’ investments were placed into the Investing at Age target dated funds. Due to the nature of the funds the asset mix and TER will depend on the term to retirement for each member.

***The total expense ratio is implicit in the bonus rate set for the current year.

The Utmost Investing at Age strategy uses an Automatic Investment Option which means it is designed to gradually reduce a member’s exposure to equities from age 55 to and through taking their retirement benefits. The strategy uses a combination of the Utmost Multi Asset Moderate and Cautious funds to achieve this balance.

For the Clerical Medical With-Profits Fund, members are also eligible to receive a final bonus at maturity. The amount of the final bonus may be lower, or nil, on transfer or encashment before maturity.

A Market Value Reduction may be applied to the With Profits Fund on transfer or encashment before maturity. This ensures that members who choose to leave the fund before their normal retirement date do so on terms that properly reflect the underlying value of their policy.

In addition to the above member-borne costs and charges, the sponsoring employer meets the cost of ongoing governance and administration services for the AVC’s.

In assessing value-for-members for the AVC scheme, the Trustees have only considered the costs and charges met by members.

The Appendix to this Statement provides an illustration of the cumulative effect of charges for the AVC scheme only and not the DC protected rights given the way members benefits are notionally attributed.

Net Investment Returns

AVCs only

The following table reflects the performance of each fund over varying periods based on investment after charges have been deducted and has taken into account the statutory guidance when preparing this section of the statement. They have been calculated on a geometric basis and assume a £10,000 investment fund.

Royal London Funds

|

Fund |

1 year |

3 years |

5 years |

10 years |

15 years |

20 years |

|

Royal London Cautious Lifestyle Strategy (default) |

||||||

|

Royal London Governed Portfolio 1 |

-0.34% |

5.92% |

3.80% |

6.34% |

7.01% |

n/a |

|

Royal London Governed Portfolio 2 (Annuity) |

-1.87% |

3.56% |

2.93% |

5.50% |

n/a |

n/a |

|

Royal London Governed Portfolio 3 (Annuity) |

-5.18% |

-1.04% |

1.08% |

3.41% |

n/a |

n/a |

|

Royal London Annuity |

-5.77% |

-3.92% |

-0.29% |

n/a |

n/a |

n/a |

|

Self-select funds |

||||||

|

Royal London Deposit |

3.38% |

1.15% |

0.90% |

0.59% |

0.73% |

1.75% |

|

Royal London European |

16.97% |

10.47% |

6.86% |

8.23% |

8.05% |

9.11% |

|

Royal London Fixed Interest |

-13.20% |

-10.15% |

-3.07% |

0.76% |

2.63% |

2.77% |

|

Royal London Managed |

0.88% |

6.92% |

4.13% |

6.32% |

6.88% |

7.03% |

|

Royal London Property |

-14.09% |

2.44% |

1.42% |

5.43% |

4.03% |

4.55% |

|

Royal London BlackRock ACS Global Equity Index (60:40) |

7.60% |

11.44% |

5.03% |

7.23% |

7.79% |

8.20% |

|

Royal London Blackrock Consensus |

4.41% |

6.50% |

4.36% |

6.30% |

6.88% |

7.38% |

|

Royal London With Profits* |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

*Royal London With Profit fund have not provided past performance information. Annual bonuses are added, and a final bonus may be payable. In 2022, an annual bonus of 2.15% was added (including profit share).

Utmost Funds

|

Fund |

Launch date |

1 year |

3 years |

5 years |

Since launch |

|

Self-select funds |

|||||

|

Utmost Multi Asset Moderate |

1 January 2020 |

1.16% |

4.45% |

n/a |

0.79% |

|

Utmost Multi Asset Cautious |

1 January 2020 |

-3.65% |

-1.19% |

n/a |

-1.79% |

|

Utmost Money Market (Deposit) |

3 December 1984 |

3.01% |

0.81% |

0.59% |

4.39% |

|

Utmost Managed |

3 December 1984 |

2.98% |

6.72% |

2.72% |

7.75% |

|

Utmost UK Equity |

3 December 1984 |

5.04% |

10.96% |

1.99% |

8.07% |

|

Clerical Medical With-Profits* |

- |

n/a |

n/a |

n/a |

n/a |

We have been unable to obtain net investment returns for the Clerical Medical With-Profits Fund. The Utmost performance has been produced to 29 July 2022.

Value for Members

Under the Occupational Pension Schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations 2021, trustees of schemes providing DC benefits are required to carry out an assessment of their scheme’s value for members from their first scheme year-end after 31 December 2021.

Following the Regulator’s guidance, an assessment of value for members has been carried out for the Protected Rights accounts which considered the following aspects:

Looking at the costs and charges, the DC benefits of the Scheme are more expensive than those quoted by another comparator DC pension provider who also include administration services within their AMC.

It should however be noted that whilst they have provided indicative terms, they are unable to accept benefits from the scheme given the underpins that exist.

Looking at net investment returns, again using the performance of the DB Scheme as a proxy in the absence of insured pooled funds for DC members. There is no default or range of self-select funds for members to choose, so attributed performance is based entirely on the growth assets of the DB Scheme.

Performance over 3 years shows solid positive returns. When reviewed against the other comparator schemes used in the assessment, the DC Section did not deliver broadly equivalent returns over the time periods considered.

There are some other areas where improvements could be made when considering Governance and Administration.

These relate to:

While falling outside the scope of the value for member assessment regulations outlined by the Pensions Regulator, we note that members have AVCs with Royal London and Utmost which appear to be satisfactory given the review that has taken place.

Overall, our assessment concludes that the DC benefits do not meet the requirements laid down by The Pensions Regulator.

There are certain changes that can be made that are simple and practical to implement which we have noted above.

We are mindful that the Regulator expects member outcomes to be improved where their standards are not met. We have taken a number of steps to explore alternative remedies. The reality is that for a small value of funds, where no new monies are being added providers are unable or unwilling to offer suitable alternative and better arrangements. We will continue to review and seek to improve the current arrangements as far as is possible.

The Trustees will consider the assessment in further detail and the recommendations contained in it with a view to implementing change where needed.

Core Financial Transactions

The Trustees receive and review reports from the Scheme’s administrators on at least a 6-monthly basis to monitor the level of administration services being provided to members.

The processing of core financial transactions is monitored by the administrators, who have implemented internal control procedures to help ensure that such transactions are processed promptly and accurately (including a relevant review process). These activities include procedures to ensure the accuracy of benefit calculations and settlements and the prompt resolution of any inconsistencies identified. Activities covered include controls and procedures to manage the settlement of benefits and individual transfers out.

The Trustees are satisfied that during the period of this statement, there have been no significant delays in processing these transactions or issues to report. The latest administration report showed that 100% of service levels were met.

Trustee Knowledge & Understanding

It is important that the Trustees continue to have sufficient knowledge and understanding to fulfil their duties. This is complemented by having a professional trustee (Capital Cranfield Trustees) on the trustee board. All new Trustees are required to undertake training following their appointment, including use of the Pensions Regulator’s Trustee Toolkit.

All Trustees have also been provided with and have a working knowledge of the Scheme’s documents including the Trust Deed and Rules, SIP and other informal policies.

The Trustees are supported by independent and professional advisers who ensure that they are kept abreast of the latest legislative, regulatory and market developments that apply to the Scheme. These advisory appointments are also periodically reviewed.

Training is delivered during Trustees’ meetings when the Trustees are considering issues, the understanding of which is enhanced through training. Relevant training materials are included in Trustees’ meeting packs.

All training received by the Trustees is recorded and the training needs of the Trustees are regularly reviewed by the Trustees and their advisers to identify any relevant gaps in knowledge.

The annual DC value for member assessment is an agenda item at the Trustees’ meeting.

In addition, Capital Cranfield Trustees are subject to AAF audit requirements which require each of its professional trustees to attend a number of technical training sessions per year.

Member Communications

Annual statutory money purchase illustrations were provided to members in respect of their AVC funds. No other DC communications were provided.

How to contact the Trustees

If you have any further queries regarding the Scheme, please contact:

First Actuarial LLP

2nd Floor

Mayesbrook House

Lawnswood Business Park

Leeds

LS16 6QY

Tel: 0113 818 7300

Email: leeds.admin@firstactuarial.co.uk

|

|

William Medlicott

Chair of the Trustees of the Jockey Club Racecourses Pension Scheme

[Date]

Appendix – Cumulative impact of costs and charges (AVC scheme only)

The tables below show the cumulative impact of costs and charges (as set out in the main body of this Statement) for the AVC scheme only.

They are presented in the format prescribed by legislation and on the specific assumptions outlined below. In considering choices, members should have regard to the impact of inflation and charges but also the actual investment performance of their fund choices.

The following table assumes a lump sum of £12,597 with assumed future growth rates by asset type as set out in the footnote, and then discounted for assumed inflation at 2.5% pa. This then shows the projected pots in “today’s money”.

Royal London – Default Funds

|

Projected Pension Pot in today’s money |

|||||||||

|

Royal London Governed Portfolio 1 |

Royal London Governed Portfolio 2 (Annuity) |

Royal London Governed Portfolio 3 (Annuity) |

Royal London Annuity |

||||||

|

Years |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

|

|

1 |

£13,049 |

£12,976 |

£13,015 |

£12,947 |

£12,932 |

£12,865 |

£12,827 |

£12,760 |

|

|

3 |

£14,002 |

£13,768 |

£13,894 |

£13,677 |

£13,628 |

£13,418 |

£13,299 |

£13,092 |

|

|

5 |

£15,025 |

£14,609 |

£14,831 |

£14,448 |

£14,361 |

£13,994 |

£13,788 |

£13,433 |

|

|

10 |

£17,920 |

£16,942 |

£17,462 |

£16,571 |

£16,373 |

£15,547 |

£15,092 |

£14,325 |

|

|

15 |

£21,373 |

£19,647 |

£20,560 |

£19,005 |

£18,666 |

£17,272 |

£16,519 |

£15,275 |

|

|

20 |

£25,492 |

£22,785 |

£24,206 |

£21,798 |

£21,281 |

£19,188 |

£18,081 |

£16,289 |

|

|

25 |

£30,405 |

£26,423 |

£28,500 |

£25,001 |

£24,262 |

£21,317 |

£19,791 |

£17,370 |

|

|

30 |

£36,265 |

£30,643 |

£33,555 |

£28,674 |

£27,660 |

£23,681 |

£21,662 |

£18,523 |

|

|

35 |

£43,253 |

£35,536 |

£39,507 |

£32,887 |

£31,534 |

£26,309 |

£23,711 |

£19,753 |

|

|

40 |

£51,589 |

£41,211 |

£46,515 |

£37,719 |

£35,951 |

£29,227 |

£25,953 |

£21,063 |

|

Other funds available to AVC Members

|

Projected Pension Pot in today’s money |

||||

|

|

Utmost Multi Asset Cautious (Highest charges) |

Royal London European (Lowest charges) |

||

|

Years |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

|

1 |

£12,962 |

£12,831 |

£13,126 |

£13,059 |

|

3 |

£13,725 |

£13,313 |

£14,252 |

£14,035 |

|

5 |

£14,532 |

£13,812 |

£15,474 |

£15,085 |

|

10 |

£16,764 |

£15,145 |

£19,008 |

£18,063 |

|

15 |

£19,339 |

£16,606 |

£23,350 |

£21,630 |

|

20 |

£22,309 |

£18,207 |

£28,683 |

£25,902 |

|

25 |

£25,736 |

£19,964 |

£35,234 |

£31,017 |

|

30 |

£29,689 |

£21,890 |

£43,281 |

£37,142 |

|

35 |

£34,249 |

£24,001 |

£53,166 |

£44,476 |

|

40 |

£39,509 |

£26,316 |

£65,309 |

£53,259 |

Assumptions:

Governed Portfolio 1 3.59% pa above inflation

Governed Portfolio 2 (Annuity) 3.32% pa above inflation

Governed Portfolio 3 (Annuity) 2.66% pa above inflation

Royal London Annuity 1.82% pa above inflation

Utmost Multi Asset Cautious 2.90% pa above inflation

Royal London European 4.20% pa above inflation

Jockey Club Racecourses Pension Scheme

Implementation Statement

Year Ending 31 July 2023

Glossary

|

ESG |

Environmental, Social and Governance |

|

Investment Adviser |

First Actuarial LLP |

|

BlackRock |

BlackRock Investment Management (UK) Limited |

|

Partners |

Partners Group AG |

|

Scheme |

Jockey Club Racecourses Pension Scheme |

|

Scheme Year |

1 August 2022 to 31 July 2023 |

|

SIP |

Statement of Investment Principles |

|

UNPRI |

United Nations Principles for Responsible Investment |

Introduction

This Implementation Statement reports on the extent to which, over the Scheme Year, the Trustees have followed their policy relating to the exercise of rights (including voting rights) attaching to the Scheme’s investments. In addition, the Implementation Statement summarises the voting behaviour of the Scheme’s investment managers and includes details of the most significant votes cast and the use of the services of proxy voting advisers.

In preparing this statement, the Trustees have considered guidance from the Department for Work & Pensions which was updated on 17 June 2022.

Relevant Investments

The Scheme’s assets are invested in pooled funds and some of those funds include an allocation to equities. Where equities are held, the investment manager has the entitlement to vote.

At the end of the Scheme Year, the Scheme invested in the following funds which included an allocation to equities:

The Partners Fund (Guernsey) typically has an allocation of only 20% to equities and accounted for only 9% of the Scheme portfolio as at 31 July 2023. This equity allocation therefore accounts for approximately 1.8% of portfolio. This is not considered to be significant by the Trustees and the Partners Fund (Guernsey) has not been included in the following analysis.

The Trustees' Policy Relating to the Exercise of Rights

Summary of the Policy

The Trustees' policy in relation to the exercise of rights (including voting rights) attaching to the investments is set out in the SIP, and a summary is as follows:

Has the Policy Been Followed During the Scheme Year?

The Trustees' opinion is that their policy relating to the exercise of rights (including voting rights) attaching to the investments has been followed during the Scheme Year. In reaching this conclusion, the following points were taken into consideration:

*Note the voting analysis was over the year ending 30 June 2023 because this was the most recent data available at the time of preparing this statement. The Trustees are satisfied that the analysis provides a fair representation of the investment manager's voting approach over the Scheme Year.

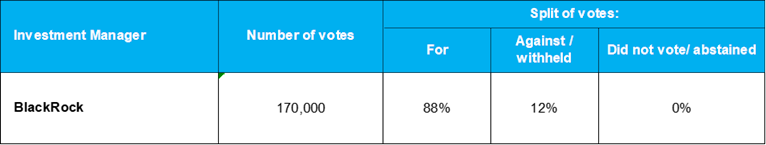

The Investment Manager's Voting Record

A summary of the investment manager's voting record is shown in the table below.

Notes

These voting statistics are based on the manager’s full voting record over the 12 months to 30 June 2023 rather than votes related solely to the funds held by the Scheme.

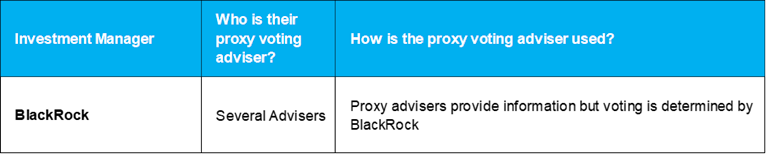

Use of Proxy Voting Advisers

The Investment Manager's Voting Behaviour

The Trustees have reviewed the voting behaviour of the investment manager by considering the following:

The Trustees have also compared the voting behaviour of the investment manager with its peers over the same period.

Further details of the approach adopted by the Trustees for assessing voting behaviour are provided in the Appendix.

The Trustees' key observations are set out below.

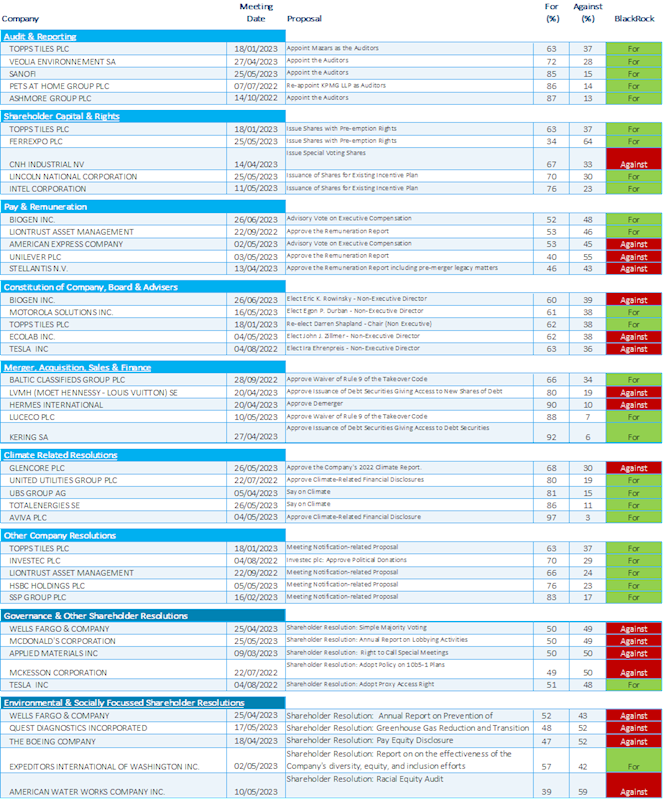

Voting in Significant Votes

Based on information provided by the Trustees' Investment Adviser, the Trustees have identified significant votes in nine separate categories. The Trustees consider votes to be more significant if they are closely contested. i.e. close to a 50:50 split for and against. A closely contested vote indicates that shareholders considered the matter to be significant enough that it should not be simply “waved through”. In addition, in such a situation, the vote of an individual investment manager is likely to be more important in the context of the overall result.

The five most significant votes in each of the nine categories based on shares held by the Scheme’s investment manager are listed in the Appendix. In addition, the Trustees considered the investment manager’s overall voting record in significant votes (i.e. votes across all stocks not just the stocks held within the funds used by the Scheme).

Analysis of Voting Behaviour

BlackRock

BlackRock appear to have reverted somewhat to a stance of being more supportive of directors and less supportive of shareholders tackling ESG issues than many of their peers.

In BlackRock’s defence, it is likely that the success of voting choice has left BlackRock with a divergent client bank. Those that wanted to take a stronger stance on ESG issues are likely to have taken up the option to let someone else take voting decisions on their behalf. The remaining clients who BlackRock continue to represent may naturally be more supportive of directors and BlackRock’s voting approach may suit them.

Partners

The Partners Fund typically has an allocation of about 20% to listed strategies but the Trustees have excluded this fund from their analysis.

The Scheme's allocation to the Partners Fund represents about 9% of total assets meaning exposure to listed strategies via the fund equates to approximately 1.8% of total Scheme assets. The Trustees do not consider this to be significant.

Partners do operate stewardship guidelines which set out principles that they will apply in all the areas we would expect them to consider. They are not signatories to the UK Corporate Governance Code but they have been assessed as A+ by UNPRI (for Strategy & Governance).

Conclusion

Based on the analysis undertaken, the Trustees have no material concerns regarding the voting records of BlackRock. However, the Trustees will keep the voting actions of BlackRock under review, noting that BlackRock’s voting records could be improved relative to some other managers.

William Medlicott Date: 8 January 2024

Signed on behalf of the Trustees of the Jockey Club Racecourses Pension Scheme

Significant Votes

The table below records how the Scheme’s investment manager voted in the most significant votes identified by the Trustees.

Note

Where the voting record has not been provided at the fund level, we rely on periodic information provided by investment managers to identify the stocks held. This means it is possible that some of the votes listed above may relate to companies that were not held within the Scheme’s pooled funds at the date of the vote. Equally, it is possible that there are votes not included above which relate to companies that were held within the Scheme’s pooled funds at the date of the vote.

Methodology for Determining Significant Votes

The methodology used to identify significant votes for this statement uses an objective measure of significance: the extent to which a vote was contested - with the most Significant Votes being those which were most closely contested.

The Trustees believe that this is a good measure of significance because, firstly, a vote is likely to be contentious if it is finely balanced, and secondly, in voting on the Trustees behalf in a finely balanced vote, an investment manager’s action will have more bearing on the outcome.

If the analysis was to rely solely on identifying closely contested votes, there is a chance many votes would be on similar topics which would not help to assess an investment manager’s entire voting record. Therefore, the assessment incorporates a thematic approach; splitting votes into nine separate categories and then identifying the most closely contested votes in each of those categories.

A consequence of this approach is that the total number of Significant Votes is large. This is helpful for assessing an investment manager’s voting record in detail but it presents a challenge when summarising the Significant Votes in this statement. Therefore, for practical purposes, the table on the previous page only includes summary information on each of the Significant Votes.

The Trustees have not provided the following information which DWP’s guidance suggests could be included in an Implementation Statement:

The Trustees are satisfied that the approach used ensures that the analysis covers a broad range of themes and that this increases the likelihood of identifying concerns about an investment manager’s voting behaviour.

The Trustees have concluded that this approach provides a more informative assessment of an investment manager’s overall voting approach than would be achieved by analysing a smaller number of votes in greater detail.